NEDRA NEWS SEPTEMBER 2019

Scott Rosensweig

Why did you decide to join the NEDRA board? I have been lucky enough in my career in prospect development to have had some amazing bosses and mentors (not to mention Ann Castle Award winners). The NEDRA community is one of the things I've valued most from my time working in this field, so getting more involved was an easy decision for me. I know its early on in your board term, but how has joining the NEDRA board impacted you? First, I have a new appreciation for the amount of work that goes into making NEDRA such a vital community that provides such incredible programming. It's also always great to hear from others in the field and I've already picked up a few great tips to put into practice. So, you work at MIT and you are in prospect management - would you share a couple prospect management tips?

Tells us about your typical weekend! In the summer, you can find me most weekends on the Cape. Otherwise, we love to explore Boston's events and festivals after doing a bit of grocery shopping at Haymarket. We live in the North End of Boston, so there is always something going on within walking distance. There may also be a jigsaw puzzle or a trip to the movie theatre worked in there. What is your dream vacation if you had limitless time and money? Exploring the beaches, wilderness, and cities of Australia, with a quick pop over to New Zealand. How to Make A Remote Position Work For You By: Christine Bariahtaris, Assistant Director, Research & Prospect Management, Facing History and Ourselves More and more employers are offering remote work arrangements in the United States. Working from home comes with many perks, but also carries a few tricky obstacles for employees used to traditional offices. About a year into my first remote role, I have learned a few lessons about how to make the most of a remote arrangement. The most difficult aspects of transitioning to a remote position center around physical workspace and its atmosphere. Setting up a home office can be a significant cost to the employee, particularly if they are trying to set up a space of similar quality to a traditional office. Employers - especially in the non-profit sector - are not always in a position to help defer the cost. A home office is also naturally isolating. It will take extra effort to create relationships with coworkers outside of your immediate team, and there is risk of disconnect from broader organizational culture if the effort is not made. Despite some initial challenges, the positive returns in a remote role can be almost immediate. A home office eliminates most of the logistics of the workday, which leads to more flexibility in your schedule and reduced stress. Any time spent in the organization’s office feels impactful and meaningful, since visits are usually for specific purposes. While isolation is a risk, a remote role can also encourage increased investment in face-time with coworkers. Employees who do well with self-directed work can particularly thrive in a remote setting, which can encourage creative thinking and a focus on quality. This leads to an increased sense of ownership and higher job satisfaction. The most positive returns from my remote role have come when I stick to three basic rules:

When I accepted my remote position, I was worried both that I would always feel like I was at work, and that I would not really know any of my coworkers. Ten months later, I can say that it is easy for a home office to feel like a cocoon, but sticking to my three rules has made a difference. A standard schedule gives me structure to escape the house - I usually spend my morning reading and playing with my dog, and use my lunches to run errands when stores are less busy. I try to come into the office at least once a month, usually for meetings where face-time is beneficial, such as a portfolio review, or large all-staff events where I can catch up with my colleagues. Monitoring our chat client keeps me in the loop between these trips. My organization also assigns a mentor, which is a great pre-established connection into the office for a remote worker. I’m not lucky enough to have a whole room to devote to an office, but I avoid my desk in my off-hours, which keeps my home life feeling separate from work. With a little thoughtful planning, remote work has turned into a huge benefit to my life, and I hope these tips can help others transition successfully. Wealthiest Block Groups: Using the Census Bureau’s American Community Survey(ACS) for Donor Income and Real Estate By: Roger Magnus, Owner, Roger Magnus Research Introduction Many prospect researchers use Forbes Wealthiest Zip Code lists compiled from residential real estate sales data or other ranked zip code lists such as Bloomberg’s compiled from IRS income data to target donors who live in those zip codes. These lists may be also be helpful if a donor’s home value cannot be located or income for someone such as a retiree or whose occupation does not have a consistent number. The ACS Another useful resource that can go to an even smaller geographic level for real estate and income data is the U.S. Census Bureau’s ACS which is a monthly survey that produces 1-year and 5-year average data. Notably, the variables such as Median Value (what price a homeowner thinks a property would sell) and Median Household Income may provide some alternative measures. In the past, the IRS income data was often higher because it included Capital Gains information. However, the gap appears to be closing as the Census Bureau implies it by asking for income from dividends, estates, and trusts and supplements its self-reported data with administrative records from the IRS The ACS contains data by more detailed County-level divisions including Census Tracts (a geography that contains 1,200-8,000 people) and Census Block Groups (600–3,000 people). (For example, in the town I live, Amherst, MA population of around 40,000, there are 2 zip codes, 6 Census Tracts, and 20 Block Groups. However, there is not a ranked list of wealthiest Census Tracts or Block Groups.) They also cover different time spans, with the latest IRS income data from 2015 and the Census Bureau’s real estate and income numbers covering a 5-year average from 2013-2017. (New 2014-2018 data will be released starting in December.) This happens because the ACS has a small sampling group, so all geographies under 65,000 population automatically have 5-year average data. The ACS data are also estimates with Margins of Error to a 90% Confidence Interval, i.e. a lower limit and upper limit within a range that the Bureau is 90 percent sure the real number lies between. This is a similar idea to a wealth capacity rating range. Some Examples To identify the corresponding Census Block Group for my home address, I go to the main page of American FactFinder (https://factfinder.census.gov/faces/nav/jsf/pages/index.xhtml and scroll down to Address Search. If I input my address, city, state, and zip code, I receive a profile of Geography Results and if I scroll down will find the corresponding Census Tract (8208.01) and Block Group (3). (To see the nearby Census Tracts and Block Groups , dig down by state and county from https://www2.census.gov/geo/maps/dc10map/tract/ ). However, American FactFinder will be phased out By June, 2020. and is being replaced by data.census.gov. Unfortunately, data.census.gov is still in Beta and only goes down to the Tract level with a big data release expected in September, 2019. Also, at this point the Address Search will not migrate to the new interface. (There is also a Census Geocoder at https://geocoding.geo.census.gov/geocoder/geographies/address? form but the results can be funky. I had to enter multiple addresses on my street besides my home address as its geographic credentials were not listed. Thankfully, other houses on my street were.) To use American FactFinder, go to factfinder.census.gov > Advanced Search >Show Me All, Geographies (drill down to All Census Block Groups), and then Topics > Dataset > 2017 ACS 5-year estimates, and then Topics > People > Income and Earnings > Income/Earnings (Households) or … Topics > Housing > Financial Characteristics > Value of Home. Then Close the Topics box and either find your table or enter more information such as “Median” in the topic or table name box. In my Census Block Group (Massachusetts > Hampshire County > Census Tract 8208.01, Block Group 3, 2013-2017 5-year average median household income is $22,695 +/- $16,912. This means that the Bureau is 90 percent confident that the real number lies in the ranges $5,783 - $39,607 - quite a broad range. (There are also Household Income tables broken down by age.) If you compare these numbers to Block Groups 1, 2, and 4 in this Census Tract, they are all considerably higher with the lowest being ($93,681 +/- $15,909). If you compare these numbers to the 01002 ZCTA (Zip Code Tabulation Area) which corresponds approximately to the zip code that covers my Census Tract and Block Group, the Median Household Income is $52,379 +/- $4,504. Even with the MOEs, it is likely that my Census Block Group has significantly lower household income compared to the other nearby geographies. However, the Median Home Values are much closer, with my Block Group having $340,000 +/- $143,665. Comparing them to find statistically significant differences can be done fairly efficiently with the Statistical Testing Tool - a spreadsheet that can be downloaded at https://www.census.gov/programs-surveys/acs/guidance/statistical-testing-tool.html. Conclusion So, the next time you are researching donor income or real estate and need area data down to a more precise geographic level, the Census Bureau’s ACS may be a useful alternative to confirm information or even find an otherwise elusive piece of the prospect research puzzle. Do’s and Don’ts of Creating Your First Prospect Profile By: Brooks Oliver, Prospect Management and Research Administrator, New England College Whether you’re taking the first steps in developing a research program, entering a small shop as a new researcher, or helping a friend get a nonprofit off the ground, one of your first orders of business should be developing a great prospect profile template. As researchers, we aim to support our front-line colleagues with the best information available to pursue fundraising opportunities. Getting that information on paper the right way is your opportunity to make a big difference. Two years ago I designed a profile from scratch as my organizations first dedicated prospect researcher, and this past June did a complete redesign to incorporate all the things I have learned since then. If I were to time travel back to 2017, here are a couple do’s and don’ts I would bring back with me for developing a knockout prospect profile the first time. I think they may help you today: Do – Make It Look Good! Who said prospect researchers can’t be creative? Your prospect profile will end up in the hands of those at the top of your organization, taking the time to design a refined document is an absolute must. Think of it like writing a resume; you want to show off the content in clean, modern, and organized format. Remember, people [in New England] read from left-to-right and memorize that way too. Don’t let something important get lost deep in the right margin. Multiple columns can help make best use of page space, and direct reading toward important points. Get friendly with design features in word, add a splash of color, and drop your organization's logo at the top of the page. Remember that your work represents them, but more importantly yourself. Don’t – Be Too Text Heavy Some of the most consistent feedback I’ve gotten from gift officers is their appreciation of a profile that is heavy on content but light on text. Although we hope that our cohorts comb through every detail of our work, with busy schedules it isn’t always possible. It’s important to build a profile that is concise and quickly communicates the key points. A good starting point is building your profile template to be more in-depth the further you read down the page. Going a step further, I’ve found it helpful to limit myself to two or three lines in text heavy areas of my profiles to cut down redundant information. You want to spend a bit more time writing, so others can spend a bit less time reading. Do – Pay Attention to Nuance No two prospects are the same, so avoid making a profile template that is too formulaic. Instead of sprawling lists, opt for compact summaries. Take for example philanthropic giving histories; a prospect may be giving to several different causes, at varying amounts, and through different sources (personally, family foundation, etc.). You can either make a list several pages long, or write a summary which gets the key points across in just a couple lines. Go for the summary, your fundraisers will thank you. Lastly, leave a spot at the top of the profile for your own research notes on each prospect. You are a professional researcher after all, and your voice is important to the strategic conversation. Don’t – Waste Space on Irrelevant or Unavailable Data When designing your prospect profile template, it’s important to take into account what resources you have available to fill it in with. Nothing looks worse on a profile than missing information. If you find yourself coming up empty in the same fields time and time again, it’s worth considering just cutting them from the profile altogether. Page space is valuable on your profiles, so you have no room for data you can’t stand behind. Ask those you work with what information is important for them to have in their process, and use that as your bible to build the profile. Your profiles are a resource to others in your organization, and taking their feedback into account from the get-go will put everyone in the right place to be successful. Do – Revisit Your Work Pay attention to how your donor profile integrates with the prospect management process. Keep track of the results of your research; what profiles were the most well received? Which yielded the best results? How did your work bring value to your organization? Not only will this information be useful for advocating for yourself down the line, but you can use to optimize your own workflow. Go back to your template periodically to make improvements, update previously completed profiles with new information, and give yourself a pat on the back for your accomplishments. Track edit history on your profiles in some way to document your efforts, and always save an editable copy before you hit print or send a pdf. Don’t – Be Too Lax About Data Security When making a prospect profile you are putting quite a bit of confidential information in one place. Always remember your responsibility to handle data securely. As a reality check, assume that your prospect’s passwords or security question answers are hiding in your profile somewhere. It’s a good idea to password protect completed profiles (you can do this in word) and choose a secure location to store your files. Consult with your organization’s IT staff on best practices to keep confidential information secure, and never leave unnecessary paper copies of prospect profiles laying around. One last big DO – Use your Network! One of the best parts of being a NEDRA member is being part of a network of highly qualified development researchers who face the same challenges you do every day. Reach out to your fellow NEDRA members to see how they put together their first prospect profile template. Don’t just take it from me, there are plenty of great ideas out there; I’ve never met a researcher who didn’t like to talk shop! If you’re still looking for a place to start, feel free to give this basic template a shot and build from there: https://drive.google.com/open?id=1Yfi3OYovzefgJIDO7HbqgFVn0xTPpo-- Happy hunting! Prospect Management on a Budget, Part 1 - Portfolio Construction By: Travis Roberts, Prospect Management Analyst, Wheaton College Every prospect management (PM) and research shop has variable staff sizes and budget concerns. Some shops have an array of fully integrated databases and systems, supported with business intelligence and visualization tools like Cognos Analytics or Tableau, or one might be the sole researcher/prospect management analyst/database manager (and more!) working with only a CRM and a few research databases. Many of us work in places that fall somewhere in between these two, but regardless of resources and staffing, if you need to build out or improve a prospect management system without access to advanced reporting or business intelligence tools the task may feel daunting, but fear not! By developing PM policies and utilizing good old-fashioned Microsoft Access and Excel, you can join disparate reports together into a cohesive moves management portfolio for review with gift officers, make it actionable with color coding, and even build in custom RFM scores and drop-down menus. This article will cover the first technical step of building a prospect management process on a budget: constructing a moves management portfolio. The second article will cover making this report actionable with color coding and dropdown menus in Excel, and the last will show you how to add an RFM score, also within Excel, to give your report some quick data analysis. Without a business intelligence tool (or if you have one but can’t build new reports with it), you might have an array of disparate reports from a variety of different systems available and no easy way to join that info into a singular, clean, moves management report. Thankfully, all of this can be achieved rather easily with Microsoft Access. However, before the actual build, you should first create a mockup of exactly the data you want to appear in a moves management report, which will then allow you to gather the variant reports together that contain the proper data. There is of course some critical data that is required, notably a unique ID number, which needs to exist in each report you intend to use as we will be setting it as a “primary key” and utilizing it to join data from variant reports together. Next, we should add other basics like constituent names, class year, constituent code (Alumni, Parent etc.), hometown and state, wealth rating, largest/last gift and allocation, and perhaps last 5 years of giving. You can vary what data you include depending on the needs of your development officers. For moves management reports, we will also need some other critical information, notably current solicitation stage (cultivation, qualification etc.), date this stage was set/how many days a prospect has been in this stage, and if available, last contact date and type of contact (last visit date as a separate breakout is helpful to see as this is a more significant contact type). If you have all this data available, great! If not, at minimum you will need current solicitation stage and when that stage was set, a requirement to later make this report actionable and color coded. It’s also helpful if one of your reports contains the exact core data you intend to keep, such as a list of all prospects assigned to certain development officers. With this information gathered, let’s get started: Step 1: With MS Access, we will be building a temporary database out of pre-existing reports. To begin we will first create tables out of our Excel reports that will feed a custom query. First open up Access, double click “blank database” and then go to the “external data” tab and click the “import Excel spreadsheet” icon (this is under “New Data Source – From File” in Excel 365), or whichever the appropriate file type your file is stored as:

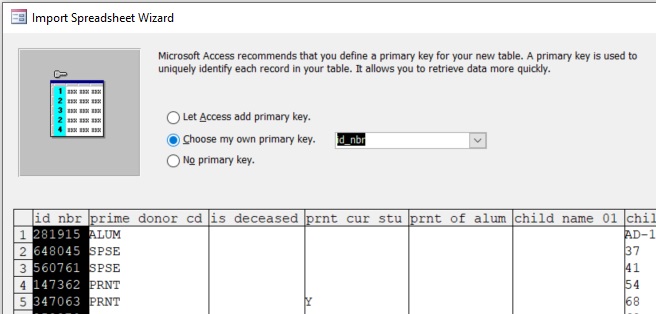

Now the import spreadsheet wizard will pop up, so select the worksheet you intend to use, click “next” and be certain to select the checkbox “First Row Contains Column Headings.” Click next again, leave the settings on this page “field name, index” etc. as they are for this project, and click next again, which brings you to the “Primary Key” selection options. This step is critical as we will be selecting the unique ID that hopefully exists in each of our files, as a primary key that uniquely identifies all records in our table. To do this, select the checkbox labeled “Choose Own Primary Key” and then select the system ID that is common throughout your reports:

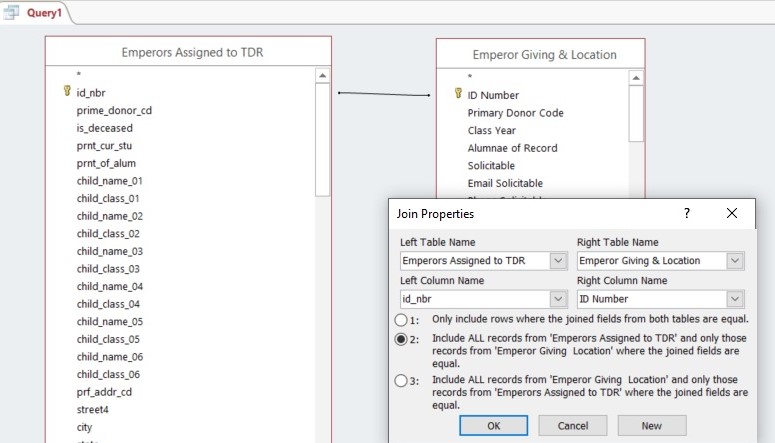

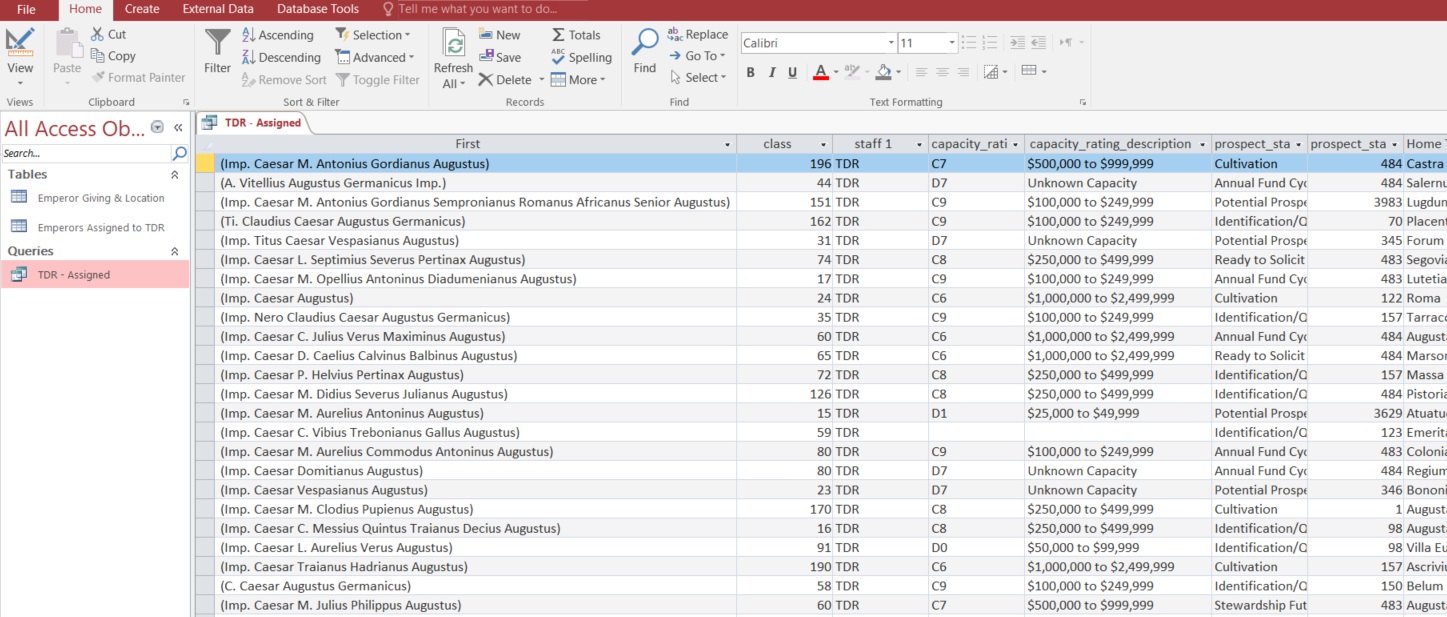

Then name your table on the final screen and click finish. Your Excel file is now a table and will appear under “tables” within the menu on the left-hand side of the screen. Repeat these steps for as many reports as you need to join. For this example, I’ll be joining two reports but I typically join 4 – 5 reports depending on what information is required. Step 2: With two or more reports listed under tables, it’s time to begin building your custom report with a query. To do this, go to the “Create” tab and select “Query Design,” which will pop up a “Show Table” window. Select the table that has the core list of names you intend to keep, such as all prospects assigned to development officers, by double clicking it, then select your other tables and they should populate into a query tab. After this, we need to join the reports together so data from each of our reports matches to the constituents listed in the primary file we are utilizing. As you will see in the image below, I’m joining two files together in my demo data file of Roman emperors assigned to me. The first step is to find the ID number we assigned primary keys earlier, then left click on “ID number” and while holding, drag the line that appears over to the other primary key in the second file (if you have a third table, drag ID# from your core table to that table rather than daisy changing). Once done, right click on the line that appears, opening the join properties menu and select option 2. This option is appropriate if the file on the left (image below) contains names you intend to retain, while joining information from other files only if they match the names in the left file. The other join types are useful for other reporting needs that won’t be covered here.

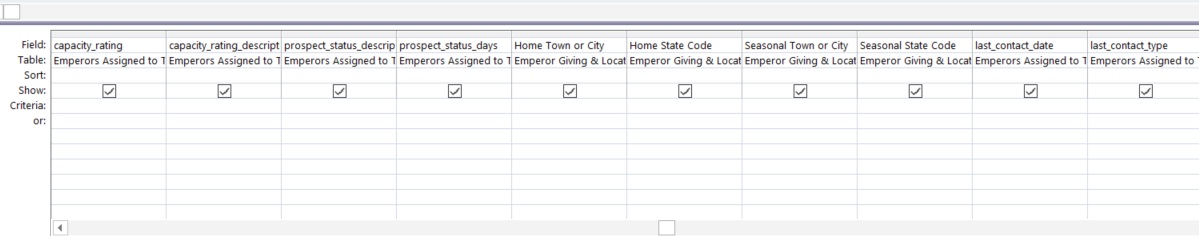

Step 3: If everything has gone right, building the actual query is very simple, you merely need to double click any of the field names you intend to appear in your report, and they will appear in a query preview window (shown below). Make sure to include all the critical data we discussed above, plus anything else you want. If you place something in the wrong order, you can drag it around in the query preview or delete it and add other data. Once done, click save, and your query will then appear under tables in the left menu. You can build multiple queries out of the tables you imported.

Step 4: Last, we want to run our report, preview it, and then export it if things look correct. To do this, go to the “Design” tab, then click “Run” and a preview of your report will appear within Access. Once here you can actually filter like you would in Excel and the resulting report will contain only those filtered results. But if not needed, you can now export your final report as is by going to “External Data” and then export to your preferred file type.

That’s it! You’ve successfully joined together disparate reports from variant reporting systems by turning them into tables and building a new report query! And if you saved your Access Database for this project, you can come back to it any time, make changes from where you last left off, and run a new report. Next time we’ll review how to turn this custom report into a color coded moves management report with actionable steps and drop down menus to help your development officers set proper stages and next steps during review sessions. Prospect Management Think Tank Thursday, September 19 — 2pm-3:30pm Prospecting on a Budget: Identifying your Pipeline through Public Data Wednesday, September 25 — 2pm-3pm Engaging Millennials to Raise Big Money Thursday, September 26 — 2:30pm-4:00pm Inclination & Capacity Estimation Tuesday, October 1 — 10am-11:30am Friday, October 4 — 9am-4pm Finding Connections (Relationship Mapping) Wednesday, October 23 — 2pm-3pm Genealogy and Prospect Research Wednesday, October 30 — 10am-11:30am Friday, December 6 — 8:30pm-4pm

|